As a business owner, you’re used to wearing plenty of different hats, from setting a strategy for the year ahead and dealing with clients, to managing staff and internal issues.

With so much on your plate, it might not come as surprise that, in a recent Experian survey below, almost a fifth of small business owners admitted to having an insufficient understanding of business credit scores.

However, as your business grows, knowing your business credit score, and more importantly, how to improve and maintain it, is essential for your continued success.

What is a business credit score?

A business credit score is a value generated by credit reference agencies like Experian. There are a whole range of different factors that contribute to how a business credit score is calculated and depending on whether your company is registered to Companies House or not, these deciding factors will differ slightly.

The resulting value is then used by banks, creditors and suppliers so they can make a well-informed decision about whether to offer you credit and the amount to offer.

A good rating can help you borrow larger amounts, or pay less interest on the amount borrowed, as lenders can use your business’ credit score as an indication that you’ll be able to meet the payment terms. The higher your score, the better your chances of getting credit.

What is a good business credit score?

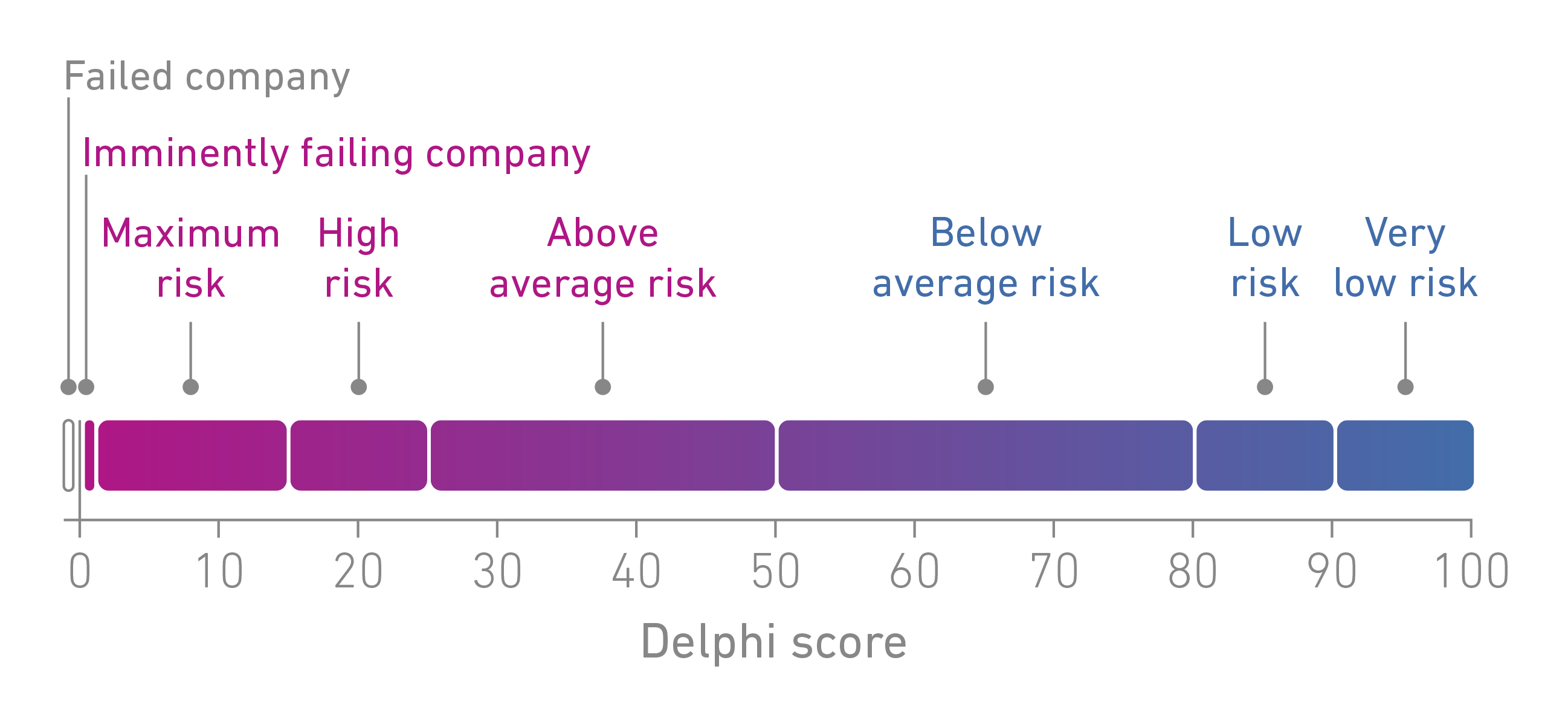

A business credit score ranges from 0 to 100. The higher the credit score is, the better position financially a business is deemed to be in. However, the closer a businesses credit score is to zero, the less likely they are to be offered credit.

The graphic below explains a little bit more about what different credit scores mean.

Fancy finding out what your business credit score is? Experian’s My Business Profile allows you to check and improve your business credit score.

What factors influence a business credit score?

A business credit score provides a snapshot of your business’ financial health, and is influenced by a number of factors, including past payment performance.

Regularly paying bills on time will be reflected in a higher credit score, which indicates to creditors that your business has a healthy positive cash flow.

As well as keeping up with payments, issues such as receiving a County Court Judgment (CCJ), can have a negative effect on your business credit score.

Why is knowing your business’ credit score important?

If a customer or another company is planning to go into business with you, it’s likely that your business credit score will influence their decision. Therefore, by monitoring your business credit score with Experian’s My Business Profile, you’ll always be up to date with the full picture of what your creditors see.

Your business credit score isn’t just important when you’re looking to get credit from the bank, it could also potentially affect which businesses choose to work with you. In fact, with tools such as Experian Business Express, the credit history of any business can be viewed at any time, by potential suppliers, business partners, or even competitors.

As a business owner, you know to expect the unexpected, but with the help of business tools from Experian, you don’t need to leave your business credit score up to chance.

Are you clued up when it comes to business credit scores?

If you’ve answered no to this, don’t worry, you’re not alone. According to a recent Experian survey1, as many as 19% of businesses said they had limited or no understanding of business credit scores and how they work. In addition, 37% of those surveyed also admitted that they didn’t know or weren’t sure of their own business’ credit score.

Given that over 73% of respondents highlighted increasing sales and profitability, and cutting costs, as their main business priority for the next 12 months, the time is ripe to get in the know about how your business credit score, along with your customers’ and suppliers’, could help steer your company to success.Starting with the basics, knowing your business credit score is an important step in ensuring your business finances are in order. Experian’s My Business Profile lets you see what creditors see before deciding whether to offer you credit. The higher your business credit score, the more chance your business has of being accepted for credit.

Given that over 73% of respondents highlighted increasing sales and profitability, and cutting costs, as their main business priority for the next 12 months, the time is ripe to get in the know about how your business credit score, along with your customers’ and suppliers’, could help steer your company to success.Starting with the basics, knowing your business credit score is an important step in ensuring your business finances are in order. Experian’s My Business Profile lets you see what creditors see before deciding whether to offer you credit. The higher your business credit score, the more chance your business has of being accepted for credit.

Cash flow will always be one of the main concerns of any business, and with so many factors to juggle, it can be hard to see whether your business finances are healthy. However, something as simple as knowing your business credit score, and also that of suppliers and customers, is a great way to ensure you’re not caught out.

Only 19% of those surveyed admitted that they check all their suppliers’ credit scores before working with them, with 40% admitting they don’t check them at all, and a further 36% saying they only check some.

Almost half of those surveyed said they don’t regularly check their suppliers’ credit score because they had not yet had a problem them. However, all it takes is one run in with a financially unstable supplier to put all your hard work at risk and it could, in turn, even lead to problems further down the line completing contracts for your customers.

Keeping an eye on your suppliers’ credit scores ensures that you’re not going to be left to pick up the pieces if one was to go into administration. Tools such as Experian’s Company Credit Check, are a quick and easy way to purchase a one-off credit report for a supplier before you start working with them so you can minimise risk and check their track record and financial stability.

As important as it is to check a supplier’s credit status, keeping tabs on any new client’s credit score is also a good way to confirm whether they’ll be able to pay you when they say they will.

Naturally, any business will be reliant on money coming in, but if you’ve been let down by a customer not paying you, this could have damaging effects on your ability to pay your creditors which may affect your own business credit score and ability to secure future credit. However, despite this, according to Experian’s recent report, 28% of businesses surveyed are still not completing credit checks on new clients, something which can again be done easily using Experian’s Company Credit Check.

When it comes to business credit scores, it can seem like a minefield, but a few simple checks really could make all the difference between whether your business sinks or swims.

For more details on Experian’s My Business Profile, and to start your 30-day free trial, click here. Alternatively, click here to find out more about Experian’s Company Credit Check tool.

1 Experian survey was conducted between December 2017 and January 2018. In total, 115 small and medium sized businesses took part in the survey.